Solana's 2025 Rollercoaster: Is the Hype Justified?

The crypto market remains a volatile beast, and Solana (SOL) has been no exception. We're ending 2025 with SOL boasting a market cap north of $14 billion and daily trading volumes averaging $1.35 billion (that's the midpoint of the reported range). Impressive, but let's dig into whether those numbers reflect genuine, sustainable growth or just another round of hype-fueled speculation. The narrative is strong – high throughput, low transaction costs – but does the underlying data support it?

Solana's Speed vs. Reality

Solana's architecture, a blend of Proof of History (PoH) and Proof of Stake (PoS), is touted as the key to its speed. The claim is 1,000+ transactions per second (TPS) with near-constant uptime. And, on the surface, the numbers back that up. They're confirming transactions in under 400 milliseconds and pushing thousands of transactions per second for fractions of a penny. But, as always, the devil's in the details.

Uptime and Network Congestion

That 99.9% uptime figure looks great, but it masks a crucial point: sensitivity to transaction spikes. Major NFT drops, for example, can still cause congestion, even if the network recovers quickly. It's like saying a highway has a speed limit of 75 mph, but traffic grinds to a halt every time there's a fender-bender. The theoretical speed is there, the real-world experience, sometimes less so. And this is the part of the report that I find genuinely puzzling. Why isn't Solana scaling better given all the theoretical advantages?

Validator Distribution and Decentralization

The other factor to consider is validator distribution. Yes, they're geographically diverse, but concentrated in regions with top-tier data centers. This isn't necessarily a bad thing – you need serious hardware to run a Solana validator – but it does raise the barrier to entry and potentially centralizes power in the hands of well-capitalized operators. The Nakamoto coefficient of 20, while comparable to other Layer-1s, isn't exactly a gold standard for decentralization.

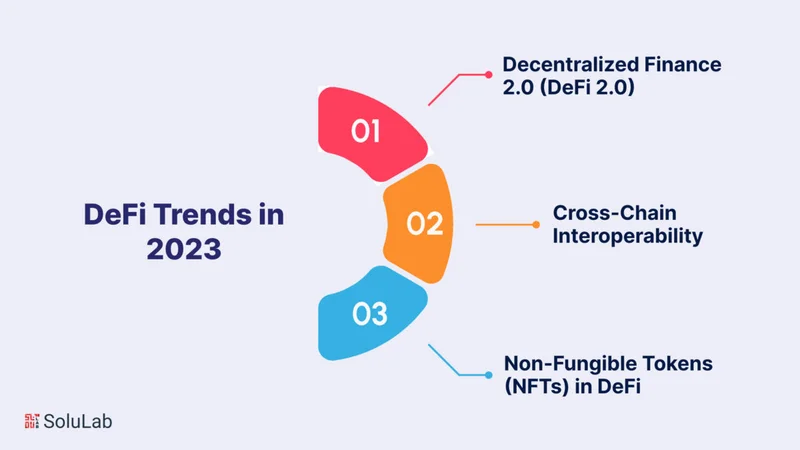

DeFi, NFTs, and the Solana Ecosystem

The ecosystem itself is a mixed bag. DeFi TVL (Total Value Locked) sits at a respectable $5.1 billion, suggesting healthy activity in lending, borrowing, and yield farming. The NFT space, while volatile, still generates significant transaction volume, which is pushing those TPS numbers. But is this activity sustainable, or driven by short-term incentives and speculative bubbles? That's the multi-billion dollar question. According to a recent report, DeFi investor trends have shifted significantly DeFi Token Performance & Investor Trends Post-October Crash.

Tokenomics and Utility

Consider the tokenomics. SOL functions primarily as a utility token, used for transaction fees and staking. This is good. It means there's actual demand tied to network usage, not just pure speculation. The inflation rate, currently around 8%, is designed to decrease over time. However, that inflation could offset any gains if network adoption stalls.

Staking and Potential Sell-offs

Staking is a major factor. Roughly 70% of SOL is staked, reducing circulating supply and (in theory) stabilizing the price. The 6-7% annual yield is attractive, but it also creates a potential for a sell-off if those staking rewards become unsustainable or if better opportunities emerge elsewhere. It's a delicate balancing act.

Solana vs. The World

The data shows a strong correlation between SOL's price and those of Bitcoin (BTC) and Ethereum (ETH). The correlation with BTC is about 0.72, and with ETH, it is around 0.68. This means that the broader market trends still heavily influence SOL's price, regardless of its underlying technology. It's not operating in a vacuum. Macroeconomic conditions and regulatory developments play a significant role, too. SEC oversight, MiCA regulations in Europe, and licensing requirements in Asia-Pacific – all of these can impact institutional investment and DeFi participation.

Price Behavior and External Factors

Looking at historical price behavior, we see surges tied to specific events – NFT launches, DeFi protocol adoption. Drawdowns, on the other hand, tend to follow broader market corrections. This suggests that SOL is still largely driven by external factors, rather than its intrinsic value. The high of $260 in 2021 to the current price of $140 (midpoint of the 2025 projection) indicates a correction to a more sustainable level, but still far from a guarantee of future growth.

Final Verdict: Utility vs. Hype

Solana has built a solid foundation with its high throughput and low fees. The ecosystem is growing, and the token has genuine utility. But the price remains susceptible to market volatility, regulatory uncertainty, and competition from other Layer-1 blockchains. The key to long-term success will be continued development, wider adoption, and the ability to weather the inevitable storms of the crypto market.